This post was co-written with Paulo Barbosa, the COO of Banfico.

Introduction

Banfico is a London-based FinTech company, providing market-leading Open Banking regulatory compliance solutions. Over 185 leading Financial Institutions and FinTech companies use Banfico to streamline their compliance process and deliver the future of banking.

Under the EU’s revised PSD2, banks can use application programming interfaces (APIs) to securely share financial data with licensed and approved third-party providers (TPPs), when there is customer consent. For example, this can allow you to track your bank balances across multiple accounts in a single budgeting app.

PSD2 requires that all parties in the open banking system are identified in real time using secured certificates. Banks must also provide a service desk to TPPs, and communicate any planned or unplanned downtime that could impact the shared services.

In this blog post, you will learn how the Red Hat OpenShift Service on AWS helped Banfico deliver their highly secure, available, and scalable Open Banking Directory — a product that enables seamless and compliant connectivity between banks and FinTech companies.

Using this modular architecture, Banfico can also serve other use cases such as confirmation of payee, which is designed to help consumers verify that the name of the recipient account, or business, is indeed the name that they intended to send money to.

Design Considerations

Banfico prioritized the following design principles when building their product:

- Scalability: Banfico needed their solution to be able to scale up seamlessly as more financial institutions and TPPs begin to utilize the solution, without any interruption to service.

- Leverage Managed Solutions and Minimize Administrative Overhead: The Banfico team wanted to focus on their areas of core competency around the product, financial services regulation, and open banking. They wanted to leverage solutions that could minimize the amount of infrastructure maintenance they have to perform.

- Reliability: Because the PSD2 regulations require real-time identification and up-to-date communication about planned or unplanned downtime, reliability was a top priority to enable stable communication channels between TPPs and banks. The Open Banking Directory therefore needed to reach availability of 99.95%.

- Security and Compliance: The Open Banking Directory needed to be highly secure, ensuring that sensitive data is protected at all times. This was also important due to Banfico’s ISO27001 certification.

To address these requirements, Banfico decided to partner up with AWS and Red Hat and use the Red Hat OpenShift Service on AWS (ROSA). This is a service operated by Red Hat and jointly supported with AWS to provide fully managed Red Hat OpenShift platform that gives them a scalable, secure, and reliable way to build their product. They also leveraged other AWS Managed Services to minimize infrastructure management tasks and focus on delivering business value for their customers.

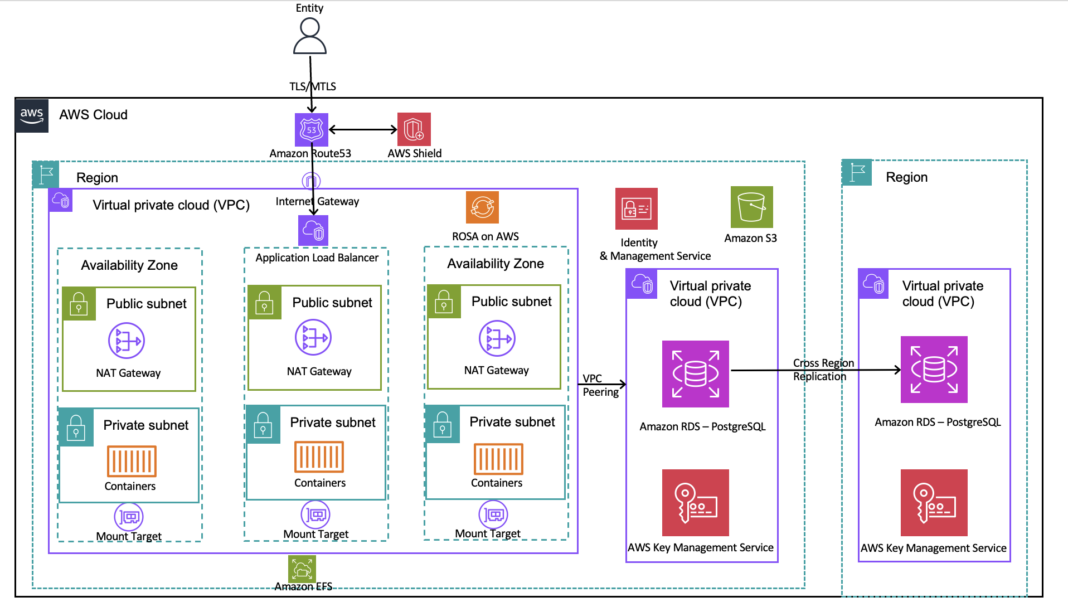

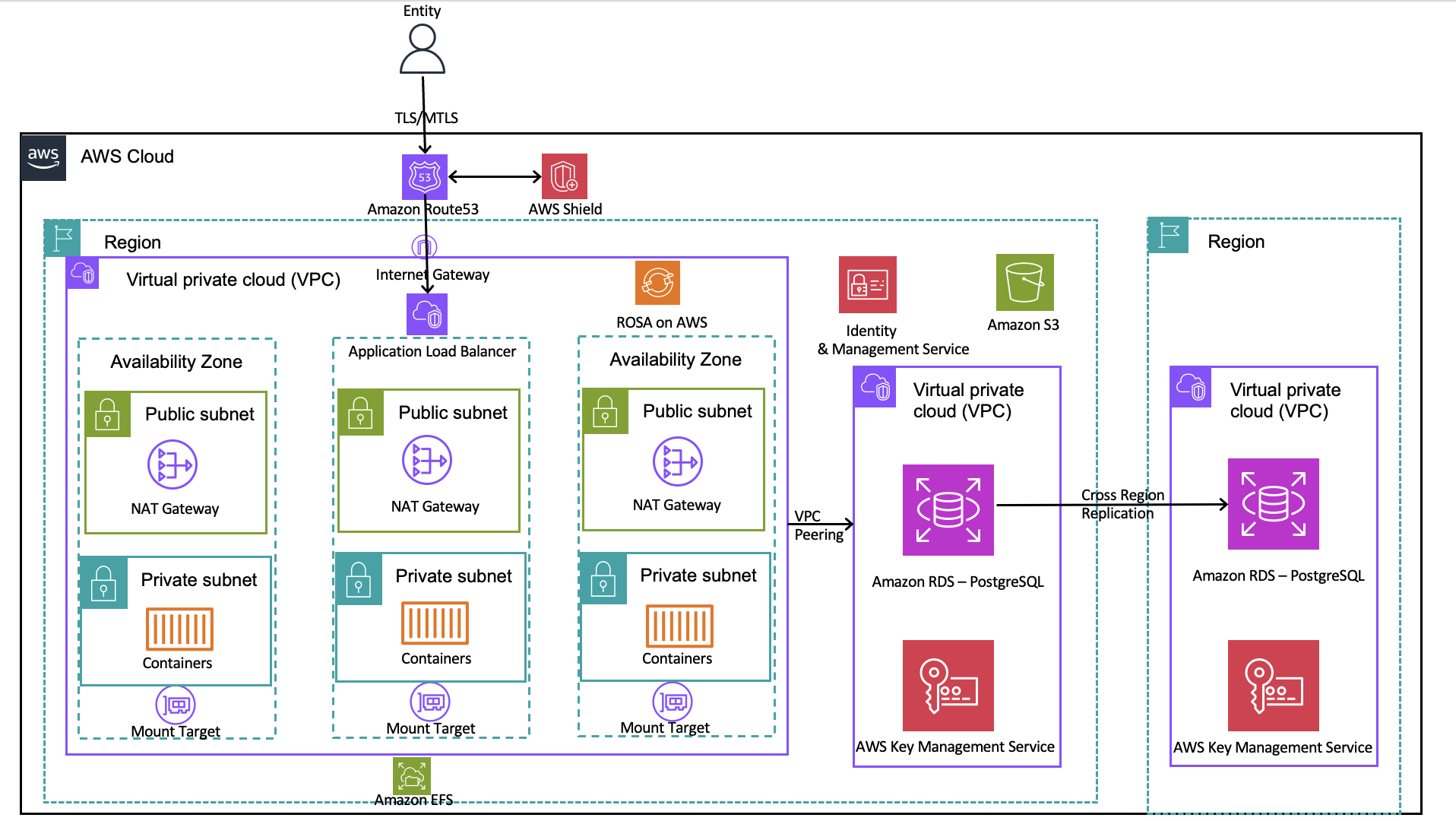

To understand how they were able to architect a solution that addressed their needs while following the design considerations, see the following reference architecture diagram.

Banfico’s Open Banking Directory Architecture Overview:

Breakdown of key components:

Red Hat OpenShift Service on AWS (ROSA) cluster: The Banfico Open Banking SaaS key services are built on a ROSA cluster that is deployed across three Availability Zones for high availability and fault tolerance. These key services support the following fundamental business capabilities:

- Their core aggregated API platform that integrates with, and provides access to banking information for TPPs.

- Facilitating transactions and payment authorizations.

- TPP authentication and authorization, more specifically:

- Checking if a certain TPP is authorized by each country’s central bank to check account information and initiate payments.

- Validating TPP certificates that are issued by Qualified Trust Service Provider (QTSPs), which are: “regulated (Qualified) to provide trusted digital certificates under the electronic Identification and Signature (eIDAS) regulation. PSD2 also requires specific types of eIDAS certificates to be issued.” – Planky Open Banking Glossary

- Certificate issuing and management. Banfico is able to issue, manage, and store digital certificates that TPPs can use to interact with Open Banking APIs.

- The collection of data from central banks across the world to collect regulated entity details.

Elastic Load Balancer (ELB): A load balancer helps Banfico deliver their highly-available and scalable product. It allows them to route traffic across their containers as they grow, and perform health checks accordingly, and it provides Banfico customers access to the application workloads running on ROSA through the ROSA router layers.

Amazon Elastic File System (Amazon EFS): During the collection of data from central banks, either through APIs or by scraping HTML, Banfico’s workloads and apps use the highly-scalable and durable Amazon EFS for shared storage. Amazon EFS automatically scales and provides high availability, simplifying operations and enabling Banfico to focus on application development and delivery.

Amazon Simple Storage Service (Amazon S3): To store digital certificates issued and managed by Banfico’s Open Banking Directory, they rely on Amazon S3, which is a highly-durable, available, and scalable object storage service.

Amazon Relational Database Service (Amazon RDS): The Open Banking Directory uses Amazon RDS PostgreSQL to store application data coming from their different containerized services. Using Amazon RDS, they are able to have a highly-available managed relational database which they also replicate to a secondary Region for disaster recovery purposes.

AWS Key Management Service (AWS KMS): Banfico uses AWS KMS to encrypt all data stored on the volumes used by Amazon RDS to make sure their data is secured.

AWS Identity and Access Management (IAM): Leveraging IAM with the principle of least privilege allows the product to follow security best practices.

AWS Shield: Banfico’s product relies on AWS Shield for DDoS protection, which helps in dynamic detection and automatic inline mitigation.

Amazon Route 53: Amazon Route 53 routes end users to Banfico’s site reliably with globally dispersed Domain Name System (DNS) servers and automatic scaling. They can set up in minutes, and having custom routing policies help Banfico maintain compliance.

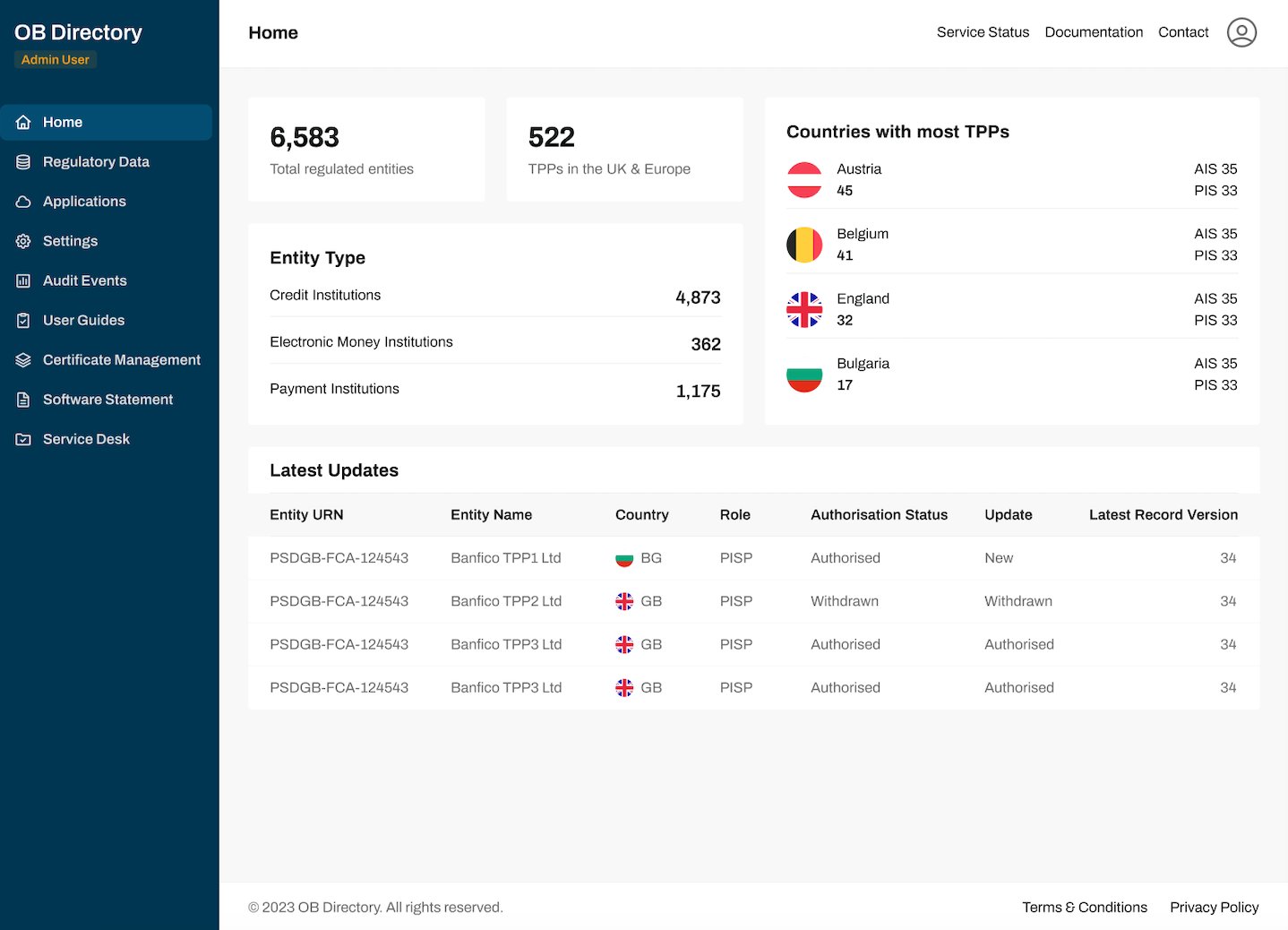

Using this architecture and AWS technologies, Banfico is able to deliver their Open Banking Directory to their customers, through a SaaS frontend as shown in the following image.

Conclusion

This AWS solution has proven instrumental in meeting Banfico’s critical business needs, delivering 99.95% availability and scalability. Through the utilization of AWS services, the Open Banking Directory product seamlessly accommodates the entirety of Banfico’s client traffic across Europe. This heightened agility not only facilitates rapid feature deployment (40% faster application development), but also enhances user satisfaction. Looking ahead, Banfico’s Open Banking Directory remains committed to fostering safety and trust within the open banking ecosystem, with AWS standing as a valued partner in Banfico’s journey toward sustained success. Customers who are looking to build their own secure and scalable products in the Financial Services Industry have access industry AWS Specialists; contact us for help in your cloud journey. You can also learn more about AWS services and solutions for financial services by visiting AWS for Financial Services.